In a previous post, I listed 5 value creation mechanisms of data and analytics from a revenue perspective. Let’s now focus on the opportunities associated with cost reduction.

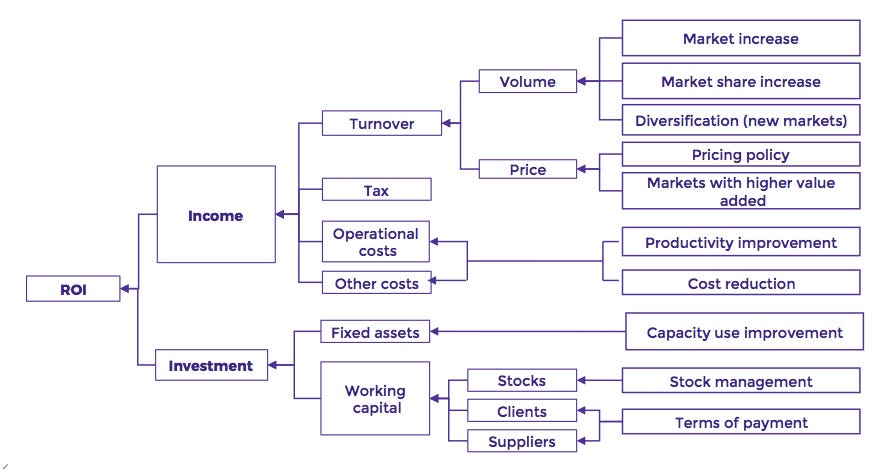

For that, I’ll use again the Dupont Analysis framework. It’s a description of the operational levers that influence the evolution of the Return on Investment (which is one way, not the only one, to measure value creation).

Let’s focus now on the lower right side of the graph to see how big data and analytics can influence positively the ROI.

- Productivity improvement: automation is a major driver of productivity improvement and data and analytics play a big role in automation. For example, when robots using real-time data are performing human tasks (like scrubbing the floors of Walmart stores) or when software analysing real-time data optimize human labor (detecting product missing in the shelves at Walmart again)

- Cost reduction: beyond automation, the other big cost reduction opportunity lies in reducing the impact or the frequency of an unplanned event. Predictive maintenance is a good example and companies like Schindler, Total or SNCF have captured a significant value preventing risks to happen or anticipating better the moment when they happen. This is made possible by the analysis of past data with machine learning.

- Capacity use improvement: assets in some industries are quite heavy (think about trucks for a logistics company, specialized machines for farmers, or refinery in oil transformation). With connected sensors, past data analysis and real-time decision making, companies can optimize the use of their assets. For example, optimising the routes of their trucks or sell their exceeding capacity on the market.

- Inventory management: it’s particularly crucial in retail. The ability to have the right number of product at the right time in the right place is a major cost reduction opportunity (it, of course, plays a role also on revenues). With real-time decision making on procurement and replenishment based on past data analysis and real-time external data (like weather and traffic), some retailers achieved a significant reduction of their inventory while maintaining an attractive merchandising of products in-store.

Like for the revenues-related value creation opportunities, big data and analytics effects are on decision-making processes. Better decision-making can, in turn, lead to improvements in organizational performance. So the two questions you should ask yourself when framing a project:

- which component of value creation will be impacted?

- what operational decision will be influenced (setting a price, offering a product, changing a part of the equipment,…)?